When Disney acquired Lucasfilm in 2012 for a staggering $4.05 billion, eyebrows were raised, and speculation about the future of Star Wars ran wild. Would the House of Mouse respect George Lucas’s galaxy far, far away, or would it transform it into a commercial juggernaut at the expense of its soul? Fast forward to today, and it’s safe to say that Disney’s acquisition has been a financial triumph, even if the force has been slightly more controversial among fans. From blockbuster films and endless merchandise to theme park expansions and streaming success, Disney’s strategic moves have turned Star Wars into one of the most lucrative franchises in entertainment history. Let’s break down how Disney has maximized the financial potential of Star Wars while ensuring that no opportunity to capitalize on the galaxy’s appeal has been left unexplored.

The Box Office Power of the Sequel Trilogy and Spin-offs

A long time ago in a galaxy…actually, not that long ago, Star Wars returned to the big screen with the Sequel Trilogy (The Force Awakens, The Last Jedi, and The Rise of Skywalker) and spin-offs like Rogue One and Solo. The anticipation surrounding these releases was intense, and Disney certainly cashed in on the hype.

The Force Awakens (2015) became an instant phenomenon, grossing over $2 billion worldwide. It broke box office records and brought Star Wars back into the cultural conversation in a way that felt both familiar and fresh. It was a financial triumph, combining nostalgia with a new generation of characters. People queued up for midnight screenings like it was 1977 all over again, proving that the franchise was still a force to be reckoned with.

Following up, The Last Jedi (2017) earned $1.33 billion worldwide, while The Rise of Skywalker (2019), though somewhat divisive, still managed to rake in over $1 billion. These numbers placed the Sequel Trilogy as one of the highest-grossing trilogies in cinematic history. Cha-ching!

Then came the spin-offs. Rogue One (2016), a gritty, standalone war film, not only expanded the narrative universe but also grossed over $1 billion globally. Meanwhile, Solo (2018) stumbled a bit, bringing in just under $400 million, which in Star Wars terms is like getting a lump of coal from Santa. Still, overall, the films under Disney’s reign have collectively grossed more than $5 billion at the box office, cementing the franchise as one of the most bankable in Hollywood.

Merchandising: More Than Just Action Figures

It’s no secret that Star Wars has always been a merchandising goldmine. But Disney’s acquisition has taken that to the next level, elevating the business of blasters, lightsabers, and Baby Yoda plush toys to a near art form. When it comes to monetizing a franchise, Disney is the Jedi Master.

Under Disney’s leadership, Star Wars merchandise has exploded. Toys, apparel, video games, LEGO sets, books, and kitchen appliances—yes, you can make toast with Darth Vader’s face on it—have become mainstays in both big-box retailers and online marketplaces. The acquisition of Lucasfilm also allowed Disney to pull the Star Wars merchandise rights back from other companies, consolidating control and maximizing profits.

According to Forbes, Star Wars merchandising has generated over $32 billion since 1977, with Disney contributing significantly to that figure in the last decade. The power of Baby Yoda (aka Grogu), who became a marketing sensation after his debut in The Mandalorian, is proof that Disney knows how to capitalize on viral characters. Baby Yoda’s image adorned everything from mugs to holiday sweaters, and these products sold like hotcakes.

Disney’s strategy is clear: why limit Star Wars to just a few toys when you can have an entire galaxy’s worth of merchandise across every conceivable category? It’s not just about selling action figures to kids anymore—it’s about creating a lifestyle brand for fans of all ages. After all, if there’s a Porg-shaped pancake maker out there, why not buy it?

Star Wars: Galaxy’s Edge—The Theme Park Experience

If there’s one thing Disney knows how to do better than anyone else, it’s creating immersive experiences. Enter Star Wars: Galaxy’s Edge, the massive theme park expansions at both Disneyland in California and Disney World in Florida. Launched in 2019, these 14-acre lands were designed to transport guests to the distant planet of Batuu, where they could drink blue milk, build their own lightsabers, and fly the Millennium Falcon.

Galaxy’s Edge was a monumental investment, reportedly costing $1 billion per location to build. However, it paid off quickly. Fans were eager to experience the Star Wars universe like never before, and the parks attracted massive crowds, particularly when they first opened. The jewel of Galaxy’s Edge is the Millennium Falcon: Smugglers Run ride, where guests can actually pilot Han Solo’s ship (with varying degrees of success, depending on your crew). Add in Star Wars: Rise of the Resistance, a groundbreaking ride that blurs the line between attraction and interactive movie, and you’ve got a theme park expansion that became a runaway hit.

The revenue from Galaxy’s Edge doesn’t stop at the turnstile, though. Disney has crafted an ecosystem of Star Wars experiences that seamlessly blend entertainment with commerce. In Galaxy’s Edge, you don’t just buy a lightsaber—you forge your own, choosing from a variety of parts in an experience that costs $200 a pop. Want a droid? You can build your own for $100. Sure, it’s an expensive trip, but for fans, it’s a dream come true. And for Disney, it’s a cash cow.

The Mandalorian and Disney+: Streaming Success

When Disney launched its streaming service, Disney+, in November 2019, the crown jewel of its original programming was The Mandalorian, a live-action Star Wars series set in the aftermath of the fall of the Empire. The show became an instant sensation, not just because of its high production values and compelling storytelling, but largely thanks to the introduction of Baby Yoda. Cue the internet breaking.

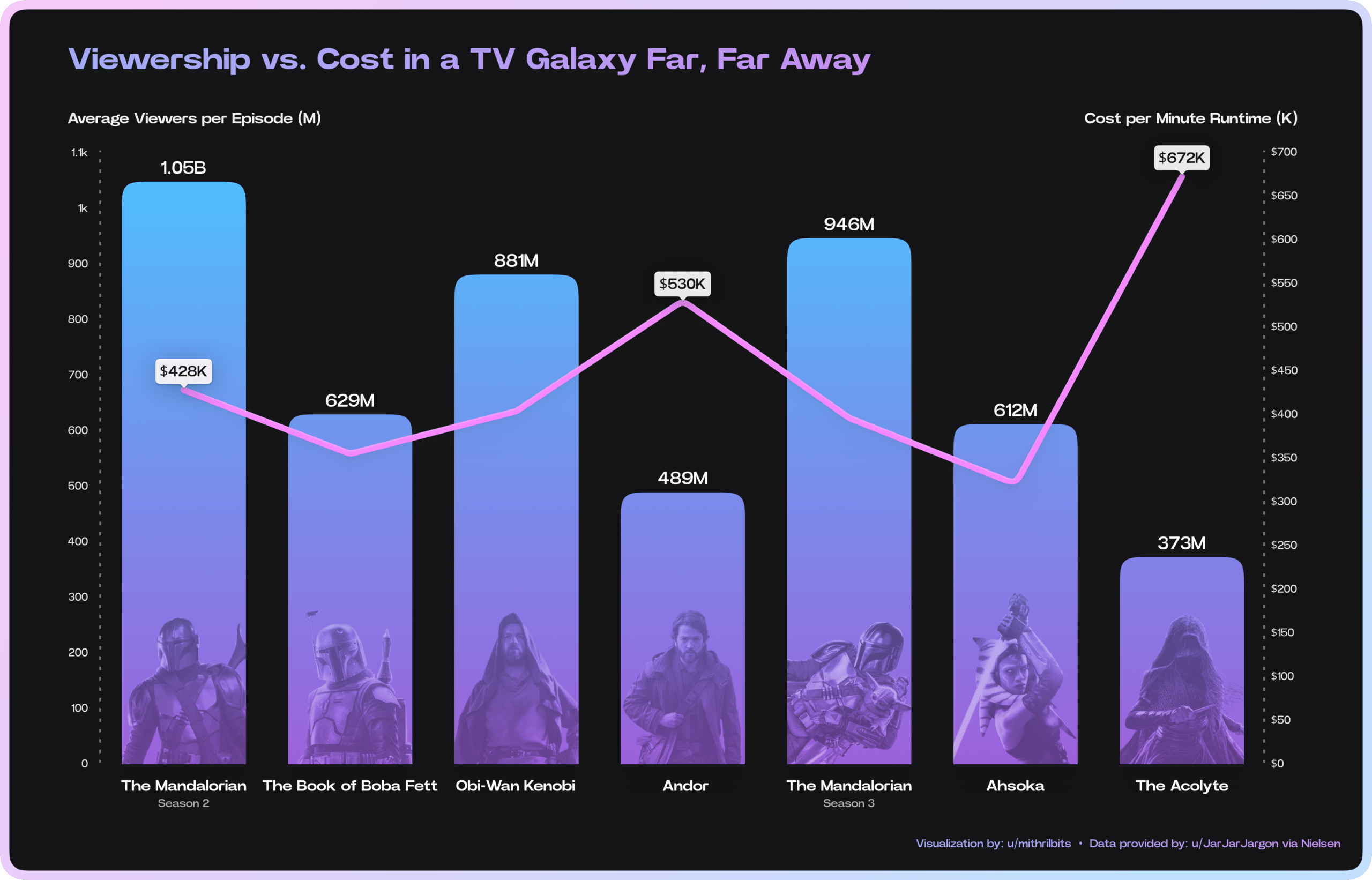

The success of The Mandalorian was monumental for Disney+. It helped propel the streaming platform to over 116 million subscribers within two years. The series became a cornerstone of Disney’s streaming strategy, proving that Star Wars content could thrive in long-form storytelling just as well as in blockbuster films. With its engaging plotlines, top-notch special effects, and beloved characters, The Mandalorian kept audiences hooked and built a devoted fan base.

Disney has since doubled down on Star Wars content for Disney+, with a slate of upcoming shows, including The Book of Boba Fett, Ahsoka, and Obi-Wan Kenobi. These series aren’t just about keeping subscribers entertained—they’re about extending the life of the Star Wars brand beyond the big screen and ensuring that there’s always a reason to remain subscribed.

For Disney, the success of The Mandalorian also opened the door to even more merchandising opportunities. The Baby Yoda craze alone generated millions in revenue, as fans clamored to get their hands on every conceivable Grogu-related product. The synergy between streaming content and merchandise is a prime example of how Disney has monetized Star Wars at every turn.

Conclusion: Disney’s Star Wars Empire

Since acquiring Star Wars, Disney has turned the franchise into a financial powerhouse that extends well beyond the confines of traditional film revenues. From the billion-dollar box office hauls of the Sequel Trilogy to the vast merchandising empire, Disney has successfully capitalized on nearly every aspect of the Star Wars brand.

The introduction of Galaxy’s Edge theme parks and the unprecedented success of The Mandalorian on Disney+ have further solidified Disney’s strategy: if there’s a way to monetize Star Wars, they’ll find it, and they’ll do it well. Though some fans may grumble about the commercial nature of the franchise under Disney’s watch, the financial impact of the acquisition is undeniable. With billions in box office earnings, merchandise sales through the roof, and streaming dominance, Disney has ensured that Star Wars remains not just a cultural phenomenon, but a financial juggernaut that will continue to generate revenue for years to come.

In other words, Disney didn’t just buy a galaxy far, far away—they bought a money-printing machine, and business is booming.