Ubisoft, once one of the giants in the video game industry, has seen its stock value nosedive over the past few years. Since its peak in 2018, the company has lost more than 80% of its market value, with shares now hovering at a 10-year low. From underperforming games to unmet expectations, Ubisoft’s journey from financial glory to struggle has been a wild ride. So, what happened, and is there a way for the company to bounce back?

A Fall from Financial Grace: The Numbers Don’t Lie

Let’s take a quick trip back to 2018, when Ubisoft was riding high. At that time, the company’s shares reached an impressive €100 per share. Fast forward to 2023, and things have changed drastically. As of this writing, Ubisoft’s stock price has plummeted to around €13.82, marking a staggering 80% decline in market value. For context, this is the lowest their shares have been since 2014.

So, how did things go so wrong for a company once positioned as a powerhouse in the gaming industry? The answer lies in a combination of underwhelming game sales, shifting industry trends, and failed strategies.

The Struggles of Recent Game Releases

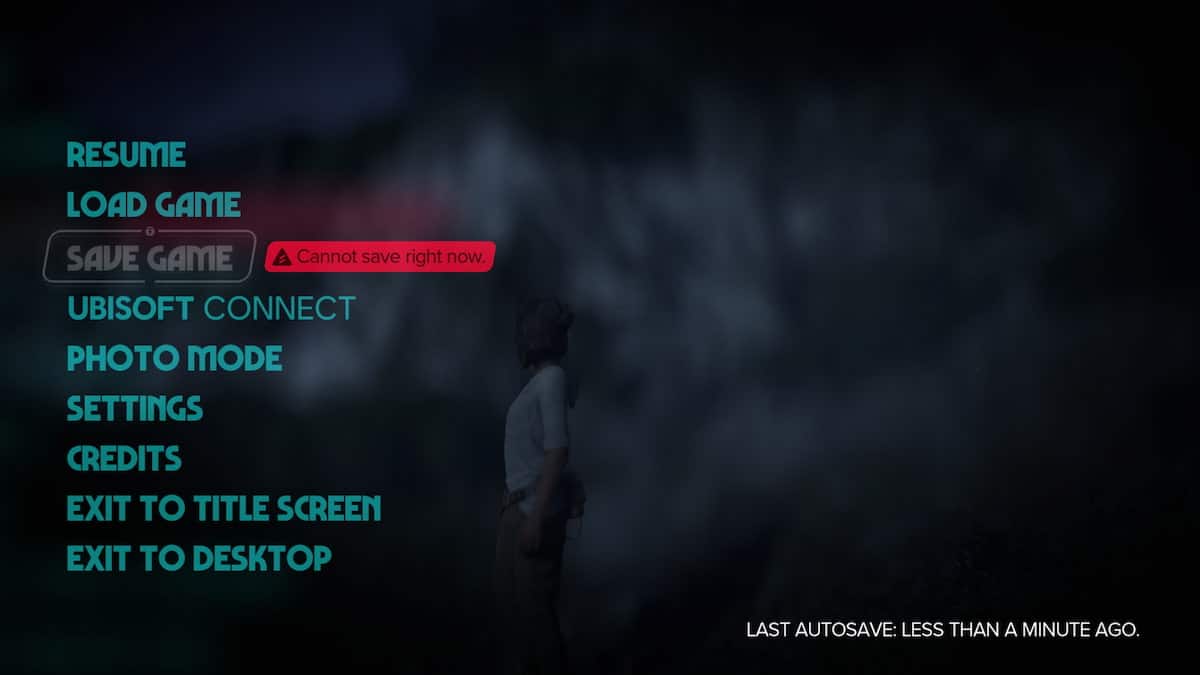

One of Ubisoft’s big hopes was its upcoming open-world Star Wars game, Star Wars Outlaws. The company was banking on this game to be a turning point, something that could reverse its financial fortunes. Unfortunately, it seems that sales for Star Wars Outlaws haven’t lived up to expectations, continuing the trend of disappointing performance that’s been plaguing the company for years.

But the problems started long before Star Wars Outlaws. In recent years, Ubisoft has struggled to release successful games. Titles like Watch Dogs: Legion underperformed, and the long-awaited Skull & Bones has been delayed so many times that it’s become somewhat of a running joke in the gaming community. To add insult to injury, XDefiant, Ubisoft’s attempt at entering the free-to-play arena shooter market, has been bleeding players since its release, failing to gain the traction Ubisoft had hoped for.

These flops have contributed heavily to Ubisoft’s current woes, as they failed to generate the revenue and player engagement that the company needed to stabilize.

A Post-Pandemic Slump

Ubisoft, like many companies, experienced a surge during the early days of the pandemic. With lockdowns in place, people turned to video games as a form of entertainment, and Ubisoft benefited from this. However, as the world began to open up again, the company couldn’t maintain that momentum.

Other game developers managed to thrive post-pandemic, but Ubisoft has struggled to adapt to the evolving gaming landscape. While competitors released hit games and expanded into new genres, Ubisoft was caught trying to fix its existing franchises and canceling new ones before they even saw the light of day.

Cancelled Projects and Shelved Franchises

A major issue for Ubisoft has been its failure to bring promising projects to market. Over the past few years, the company has canceled several high-profile games that were in development, including a number of free-to-play titles. Some of these projects had been in development for years, representing a huge waste of resources and further contributing to the company’s financial instability.

Additionally, once-popular franchises like Watch Dogs have been shelved due to declining interest, leaving Ubisoft scrambling to create new IPs or revive old ones. Their reliance on big franchises like Assassin’s Creed has become both a strength and a weakness. While the Assassin’s Creed series continues to sell well, the company’s overreliance on this one franchise has left it vulnerable when those games don’t perform as expected.

Defensive Investments: A Hedge Against Failure?

In an effort to stave off a complete collapse, Ubisoft has taken on significant investments from hedge funds like BlackRock and Tencent. These investments were meant to keep the company afloat and fend off any potential hostile takeovers, such as the one attempted by Vivendi in the past.

While these investments have provided a short-term solution, they haven’t been enough to fix Ubisoft’s long-term problems. Ubisoft’s strategy to “stay the course” instead of selling the company might have kept it independent, but at what cost? The company continues to bleed value, and the investment funds have yet to yield a noticeable turnaround.

Can Ubisoft Bounce Back?

Despite all these setbacks, it’s not all doom and gloom for Ubisoft. The company still has a few opportunities to bounce back. Later this year, they’re set to release Assassin’s Creed Shadows, the first game in the franchise set in Japan. There’s considerable hype around this release, and if the game performs well, it could help restore some faith in Ubisoft’s ability to produce high-quality titles.

In addition, Ubisoft has an extensive back catalog of beloved franchises and the potential to create new IPs that capture the imagination of gamers. But to do so, they’ll need to rethink their strategy, focus on producing games that are innovative and polished, and perhaps let go of the free-to-play obsession that has led to so many failures.

Final Thoughts: Is There Hope for Ubisoft?

Ubisoft’s journey from a high-flying gaming giant to a company in crisis has been one filled with missteps, missed opportunities, and, frankly, some bad luck. The decline of over 80% in market value is a stark reminder that even the biggest players in the gaming industry aren’t immune to failure.

However, all is not lost. If Ubisoft can learn from its mistakes, refocus its efforts on delivering high-quality, polished games, and successfully launch upcoming titles like Assassin’s Creed Shadows, there’s a chance for a turnaround. But for now, the company is in a precarious position, and only time will tell if they can reclaim their former glory.

If you’re a fan of Ubisoft, there’s still hope. But if you’re an investor… well, maybe it’s time to start considering whether the Assassin’s Creed movie was really worth all this trouble.